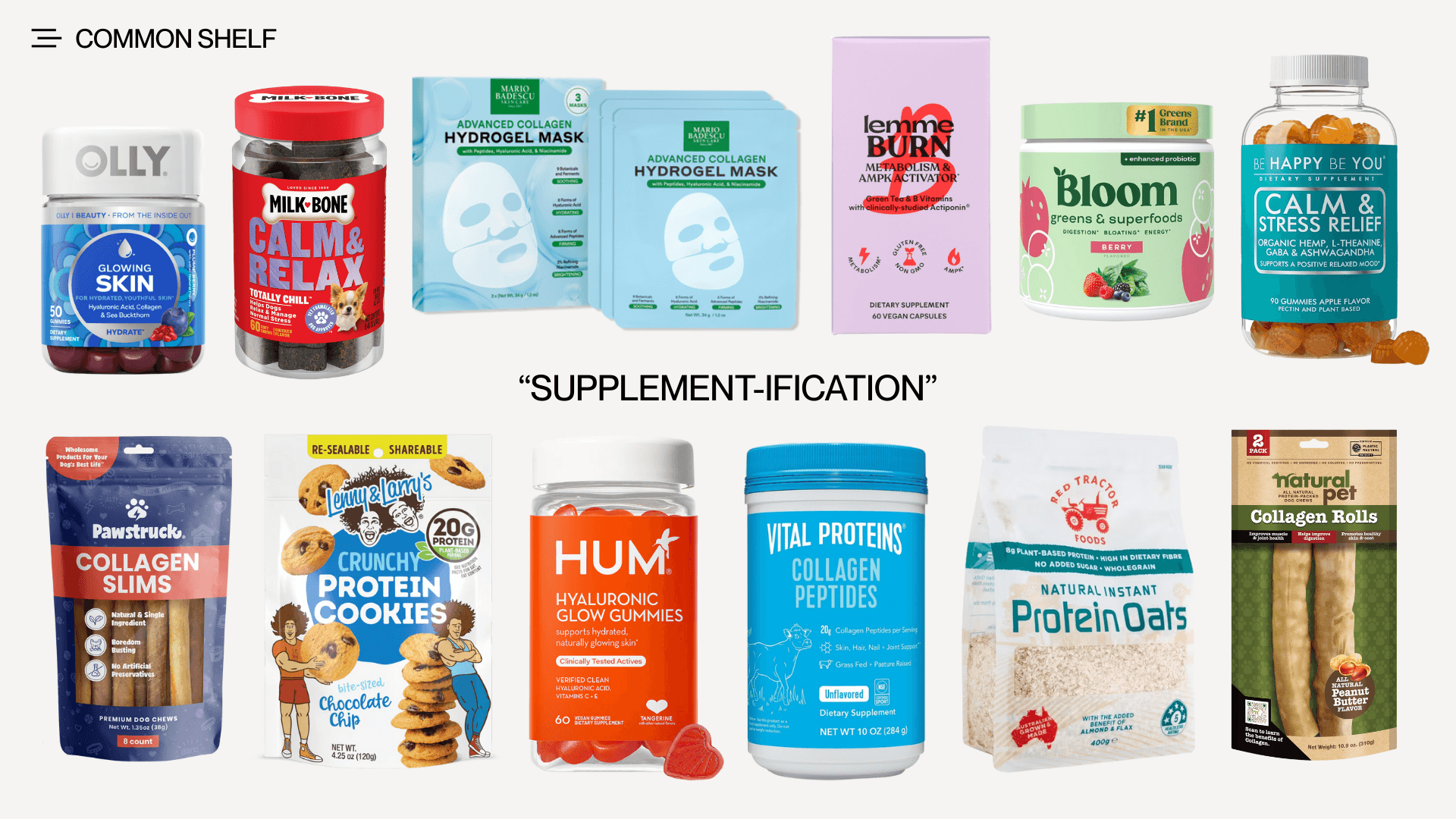

Protein snacks. Hyaluronic acid gummies. Collagen pet treats. Different aisles, same play: take a benefit people already recognize from supplements, make it snackable, and sell it with packaging that reads in 3 seconds.

This pattern reflects a structural change in how functional benefits are delivered and discovered. The line between food, supplements, and functional wellness is collapsing, and the clearest real-world evidence is showing up in off-price retail, where shoppers make fast, impulse-led decisions in “trending” aisles.

NielsenIQ captured it bluntly: ingredients that used to live in capsule form are now showing up in food and beverage formats, and it’s accelerating. NIQ reports protein is up +80.6% in functional snacks (and +100.9% in functional beverages), while collagen is up +329.9% in snacks (and +144.6% in beverages).

That’s the trend. Off-price is the proof engine.

Why off-price is where this trend becomes obvious

Off-price doesn’t behave like a “planned purchase” environment. It’s a discovery machine. People go in to browse, compare, and leave with things they didn’t know they wanted.

Placer.ai data shows shoppers are spending meaningfully longer inside off-price stores than traditional apparel retailers. In 2025, average dwell time was ~40.3 minutes at T.J. Maxx and ~43.9 minutes at Burlington vs ~33.3 minutes at apparel chains. We know this to be true, especially based on our findings in this article: Department Stores are Losing to Off-Price.

That matters because longer dwell time + discovery behavior = a perfect environment for ingredient-led impulse buys.

And traffic is up. Placer.ai reported 2024 YoY visit growth at major off-price leaders including Burlington (+7.9%), Marshalls (+5.3%), T.J. Maxx (+4.9%), and Ross (+0.7%).

So you have:

More shoppers,

Browsing longer,

In stores designed for treasure-hunt discovery,

In aisles where “benefits” sell faster than brand loyalty.

The real product being sold: a benefit you can read instantly

In a trending aisle, shoppers aren’t evaluating clinical studies. They’re scanning for a familiar ingredient + a promised outcome.

That’s why “supplement ingredients” are winning: they’re already legible.

Protein = energy, satiety, fitness, “better-for-you”

Hyaluronic acid = hydration, skin glow, beauty-from-within

Collagen = joints, skin, hair, recovery (and now… pets)

This shows up in the broader market data too:

Protein snacks aren’t slowing down

The global protein snacks market is expected to hit $32.01B in 2025 and grow to $46.34B by 2030 (CAGR 7.68%). (Mordor Intelligence, 2025)

Also, the broader snack industry is huge, SNAC International pegs snack sales at $156B, up 4.8% over the past year.

Hyaluronic acid is becoming a mainstream supplement format

One estimate has the hyaluronic acid supplement market growing from $2.54B (2024) to $2.81B (2025), a 10.5% jump. (Research and Markets)

Whether consumers buy “HA gummies” for skin, joints, or both, the key is: they recognize the ingredient.

Pet is following the same playbook

The pet chews and treats market is projected at $11.8B in 2025 (up from $11.2B in 2024) and forecast to reach $21.2B by 2034 (CAGR 6.7%).

And collagen specifically in pet products is now big enough to be measured as its own category: one report values the pet food collagen market at $989.4M in 2025. (Future Market Insights)

This is the same cultural shift, repeated: functional benefits migrate into everyday formats, then scale.

Why packaging decides the winner in off-price “trend aisles”

In off-price, a product has to do three jobs fast:

Signal the benefit (ingredient callout)

Signal trust (clean design, recognizable cues)

Signal value (size, count, “compare at,” bundle, etc.)

McKinsey’s packaging research underscores that packaging characteristics remain highly influential in purchase decisions, especially around practical cues like food safety and shelf life.

Translation for off-price: if your packaging makes the shopper feel confident and smart for buying it, you win.

Off-price is where “ingredient + outcome + value” becomes the new brand.

What brands should take from this (especially if you care about off-price)

If you’re a founder/operator, this trend should change how you think about “off-price readiness.”

Because in trend aisles, the hero is the benefit, not the brand story.

The practical playbook:

Choose one primary ingredient-led claim (protein / HA / collagen / creatine, etc.)

Make it readable at 6 feet (big type beats clever copy)

Engineer the value (count, bundle, “compare at,” clear reason it’s a deal)

Keep the format impulse-friendly (gummies, chews, bite-size snacks)

If NIQ is seeing triple-digit growth in ingredients like collagen showing up in food/snack formats, and off-price traffic + dwell time keeps rising, this doesn’t cool off next quarter.

It becomes the new baseline for how consumers shop.

Latest in Off-Price