For many consumer brands, landing in Target represents a major milestone.

It signals legitimacy. It delivers national visibility. It places your product alongside category leaders.

That visibility often carries an implicit assumption:

Target is where profitability lives.

A closer look at contribution margin tells a more precise story.

When you evaluate retail channels at the P&L level, off-price retailers like TJ Maxx frequently outperform traditional big-box retail on net profitability, even with lower retail prices.

This article breaks down why that happens, what the numbers actually show, and how founders should think about retail channel mix going into 2026.

Why Everyday Retail Feels Like the Default Choice

Retailers like Target and Ulta offer a familiar value proposition:

Full-price presentation

Promotional visibility

National distribution

Long-term brand presence

On the surface, the economics appear straightforward:

MSRP: $19.99

Retail price: $19.99

Retail margin: ~45–50%

That clarity at the top of the P&L often drives early enthusiasm.

Profitability, however, is determined further down the stack, where operational requirements, promotional participation, and ongoing costs shape what brands actually keep.

Industry research from McKinsey highlights how promotional intensity in mass retail steadily compresses net margins, even as top-line sales remain strong

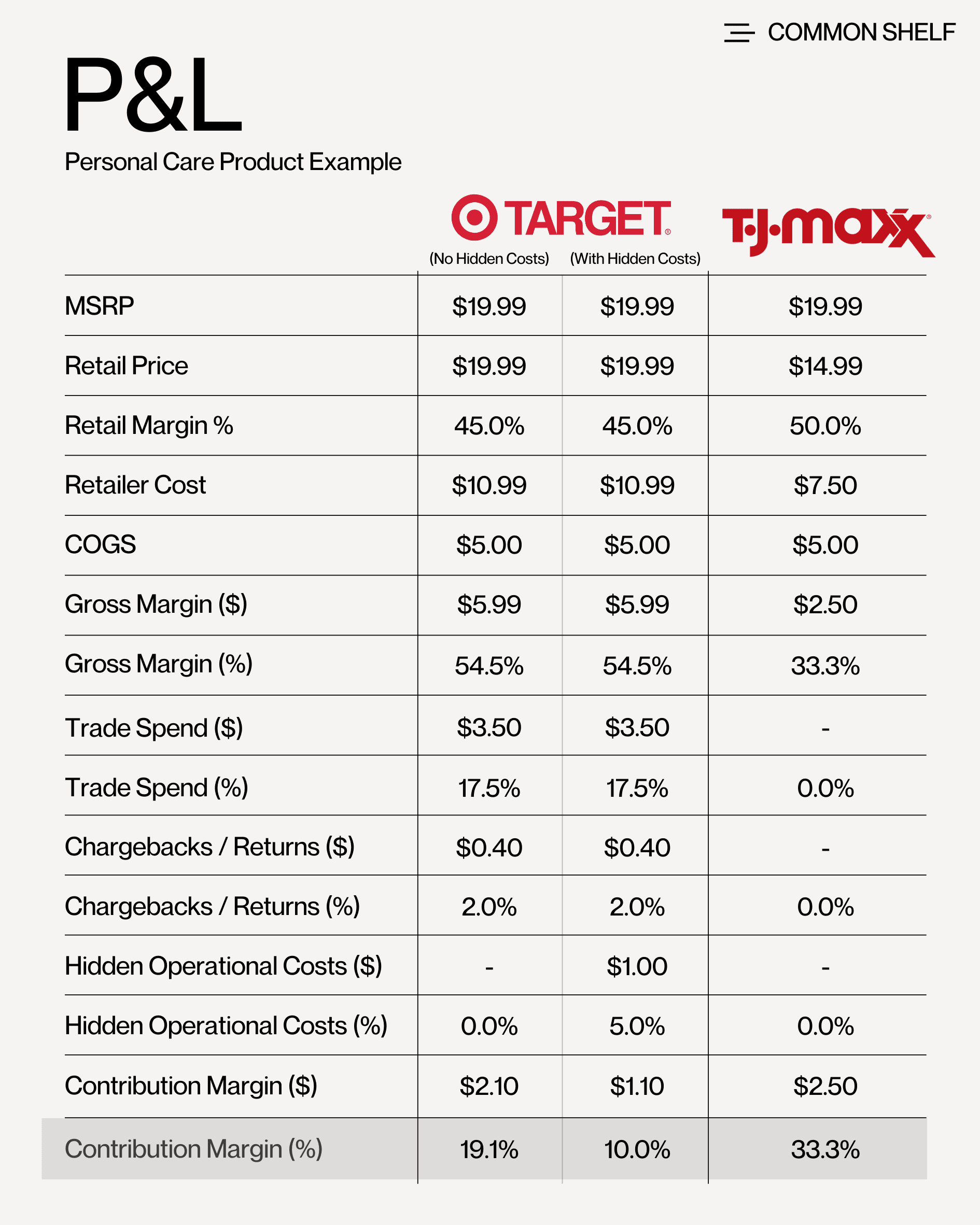

One Product, Two Channels, Two Outcomes

Using the P&L breakdown below, let’s compare a single personal care product across two retailers.

Product Economics (Held Constant)

MSRP: $19.99

COGS: $5.00

Category: Personal care / beauty

The formulation, manufacturing cost, and brand positioning remain the same.

Only the retail channel changes.

Target: High Visibility, Compressed Contribution

At Target, the product maintains full-price presentation:

Retail price: $19.99

Retailer cost: $10.99

Gross margin (brand): ~$5.99

That gross margin appears healthy in isolation. Contribution margin is shaped by what follows.

Margin Drivers in Everyday Retail

Target economics typically include:

Trade spend: ~$3.50 per unit (≈17.5%)

Chargebacks and returns: ~2% of retail price

Operational requirements:

Compliance programs

Shipping penalties

Competitive markdown pressure

Promotional participation

NielsenIQ reports that trade spend alone commonly accounts for 15–25% of revenue in mass retail categories, materially impacting brand profitability.

Net Result at Target

Contribution margin: $1.10 per unit

Contribution margin %: ~10%

Target offers scale and visibility, with profitability that depends on sustained promotional investment and operational precision.

TJ Maxx: Lower Retail, Stronger Net Economics

TJ Maxx operates under a different retail structure.

Retail price: $14.99

While the shelf price is lower, the economic model is streamlined.

Off-Price Economics in Practice

No trade spend

No promotional funding

No chargebacks

No ongoing compliance fees

Terms are defined upfront, and margins remain stable throughout the sell-through period.

Net Result at TJ Maxx

Retailer cost: ~$7.50

Gross margin (brand): ~$2.50

Contribution margin %: 33.3%

The result is a significantly higher contribution margin, achieved through operational simplicity rather than higher shelf price.

Why Simplicity Drives Profitability in Off-Price

Off-price profitability is built on clarity.

TJ Maxx prioritizes:

Discovery-led shopping

Impulse decision-making

Immediate value recognition

Brands are evaluated on whether the product communicates clearly and performs quickly on shelf.

This structure supports consistency. TJX has reported sustained traffic and comparable-store sales growth across cycles, reinforcing the durability of the model.

The Metric That Matters Most: Contribution Margin

Many brands evaluate channels using gross margin percentage.

Contribution margin provides a more accurate lens.

It accounts for:

Net dollars retained

Cashflow timing

Cost volatility

Operational predictability

A channel that delivers stable, repeatable contribution often supports growth more effectively than one with higher headline margins and variable net outcomes.

Brand Perception and Off-Price Placement

Brand integrity remains a core concern for founders.

Off-price programs that perform well typically include:

Exclusive SKUs or formats

Engineered value formats

Clean dating and presentation

Controlled retail banners

Consumer behavior supports this approach. Placer.ai data shows off-price retailers outperforming many traditional chains on visit frequency and dwell time, reinforcing their role as intentional discovery destinations.

Off-Price as a Customer Acquisition Lever

Off-price retail introduces brands to new customers at scale.

Each unit sold delivers:

Brand exposure

Trial

Discovery

This effect compounds as digital acquisition costs rise. Recent reporting highlights continued increases in social ad costs across Meta and TikTok, raising CAC for DTC brands.

Off-price functions as physical customer acquisition, funded by the retail environment rather than paid media.

Channel Fit and Strategic Use

Target excels for brands with:

Scale to absorb trade spend

Long-term promotional budgets

Operational infrastructure

Off-price performs well for brands prioritizing:

Contribution margin

Cashflow stability

Inventory flexibility

Speed to market

A diversified retail strategy aligns channels with specific business objectives rather than perceived prestige.

The Strategic Question for 2026

The most useful question for founders is:

Which retail channels reliably fund the next stage of growth?

Net contribution, cashflow timing, and operational clarity determine that answer.

In many cases, off-price provides a durable and profitable foundation.

Closing Perspective

Retail success increasingly depends on disciplined channel design. Brands that evaluate channels through contribution margin gain clearer visibility into what truly drives profitability.

Latest in Off-Price